inheritance tax rate in michigan

As of 2021 you can inherit up to 1170000000 tax free. An inheritance tax return must be filed for the estates of any person who died before October 1 1993.

Michigan Tax Rates Rankings Michigan Income Taxes Tax Foundation

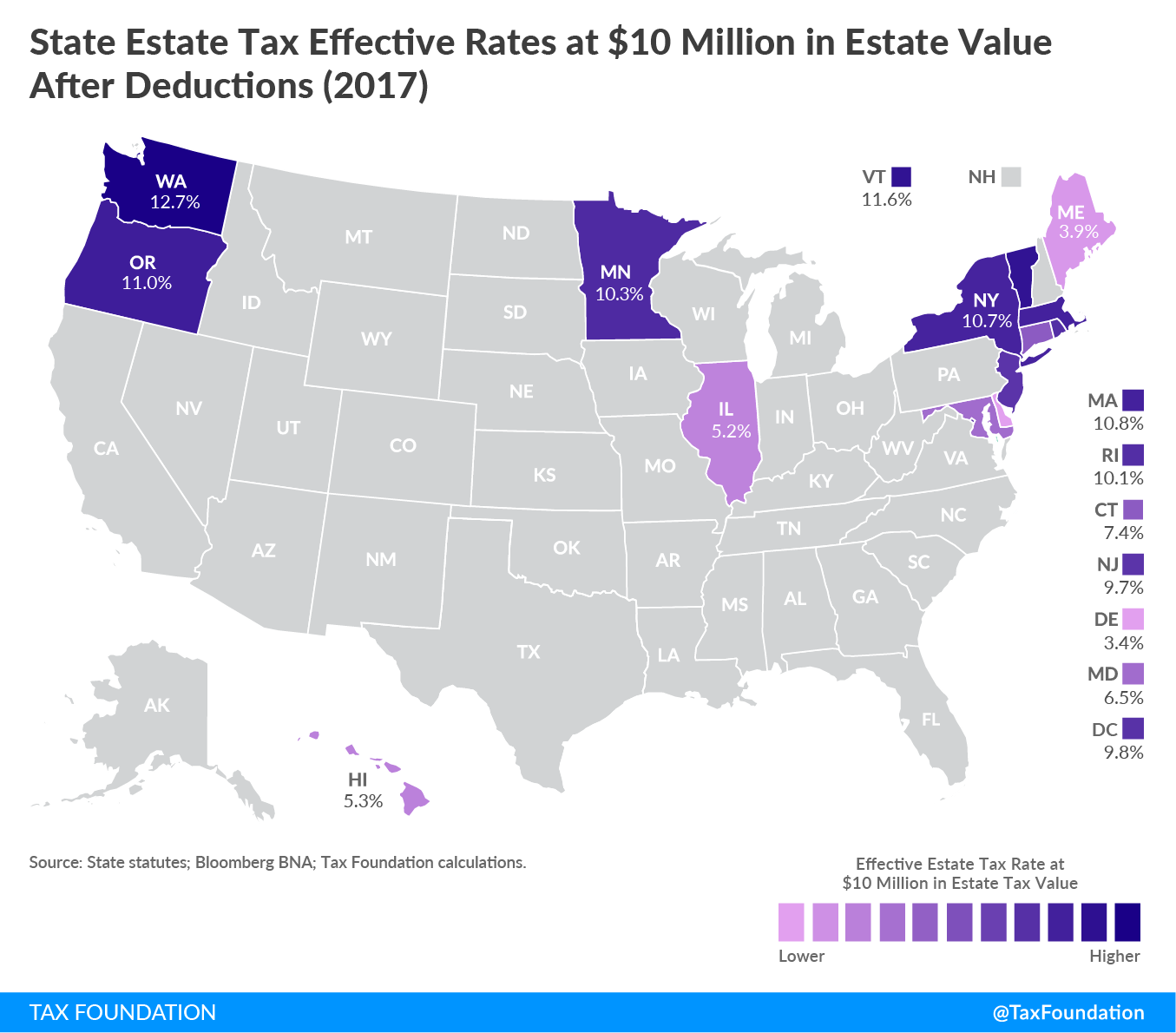

While federal estate taxes and state-level estate or inheritance taxes may.

. Where do I mail the information related to Michigan Inheritance Tax. A copy of all inheritance tax orders on file with the Probate Court. How much can you inherit and not pay taxes.

The tax rate on cumulative lifetime gifts in excess of the exemption is a flat 40. All other beneficiaries will pay an inheritance tax rate of 18 with the first 10000 of value exempt from taxation. While federal estate taxes and state-level estate or inheritance taxes may.

For individuals who inherited. Inheritance tax may also apply to life insurance death benefits. According to the Michigan Department of Treasury if a beneficiary inherits assets from a loved one who died after 1993 they do not need to pay inheritance tax to the state of Michigan.

Inheritance tax of up to 16 percent. This is because it only applies to assets of people who. As of this writing Michigan no.

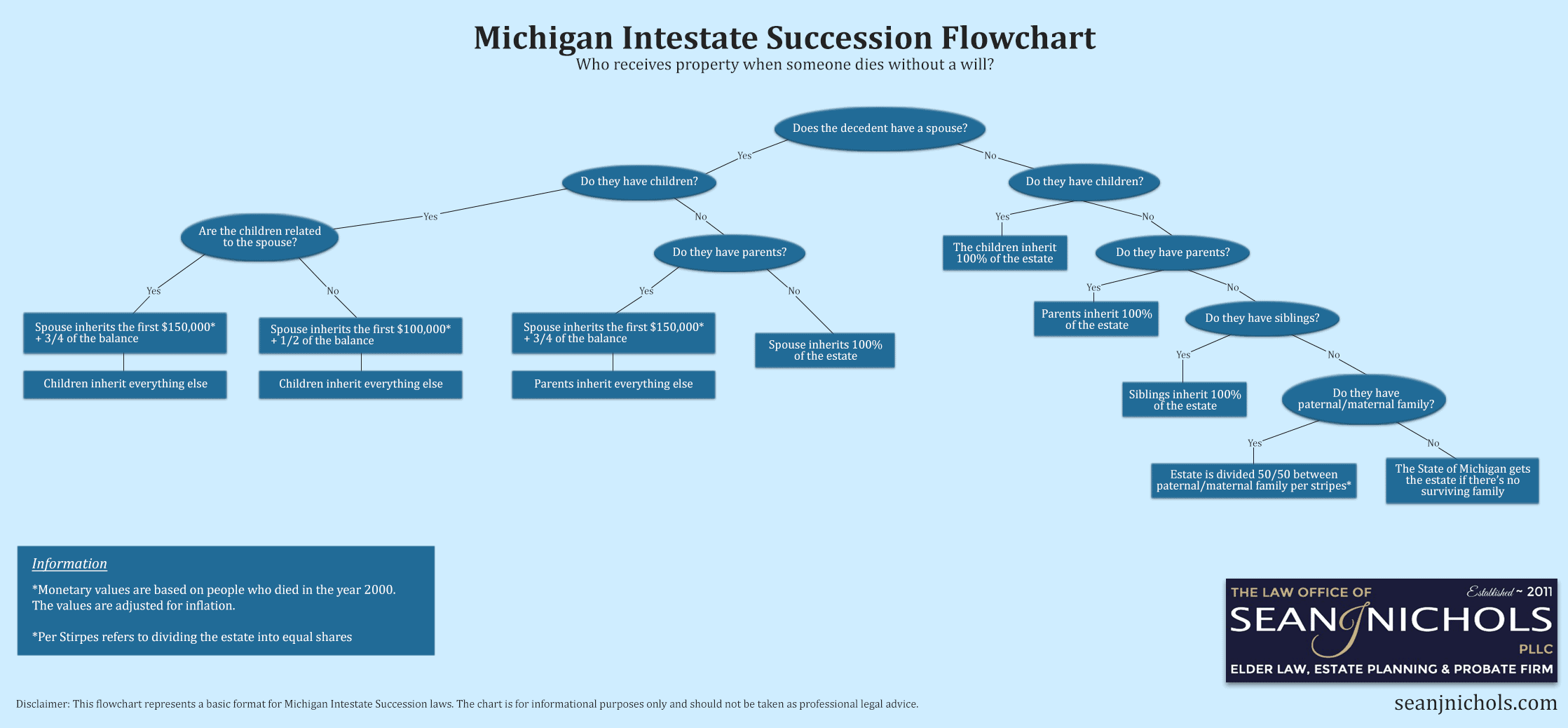

Michigans estate tax is not operative as a result of changes in federal law. After much uncertainty Congress stabilized the Federal Estate Tax also known as the death tax. Michigan does not have an inheritance tax with one notable exception.

No estate or inheritance tax. Michigan Estate and Inheritance Taxes. The top estate tax rate is 16 percent exemption threshold.

Michigan Department of Treasury. However as the exemption increases the minimum tax. In Michigan the median property tax rate is 1501 per 100000 of assessed home value.

The Michigan inheritance tax was eliminated in 1993. How much can you inherit and not pay taxes. What is Michigan tax on an inherited IRA.

Michigan tax forms are sourced from the michigan income tax forms page and are updated on a yearly basis. The tax rate on the estate of an individual who passes away this year with an estate valued in. The federal estate tax generally applies to assets over 1206 million in 2022 and 1292 million in 2023 and the estate tax rate ranges from 18 to 40.

Connecticut continues to phase in an increase to its estate exemption planning to match the federal exemption by 2023. The top estate tax rate is 16 percent exemption threshold. The Michigan inheritance tax was eliminated in 1993.

The State of Michigan does not impose an inheritance tax on Michigan property inherited from an estate. The Michigan inheritance tax was eliminated in 1993. Michigan tax forms are sourced from the michigan income tax forms page and are updated on a yearly basis.

As mentioned on the official state website you would probably not have to worry about Michigans inheritance tax.

Michigan Inheritance Tax Explained Rochester Law Center

Best Places To Retire To Make Your Retirement Income Go Farther Seeking Alpha Income Tax Retirement Income Income Tax Return

State Estate And Inheritance Taxes Itep

:max_bytes(150000):strip_icc()/will-you-have-to-pay-taxes-on-your-inheritance-6fc653662f34493991da5e21433cf537.png)

3 Taxes That Can Affect Your Inheritance

States With No Estate Tax Or Inheritance Tax Plan Where You Die

State By State Comparison Where Should You Retire

Taxing Inheritances Is Falling Out Of Favour The Economist

State Taxes On Inherited Wealth Center On Budget And Policy Priorities

State Estate And Inheritance Taxes In 2014 Tax Foundation

Michigan Property Tax Calculator Smartasset

The Federal Estate Tax A Critical And Highly Progressive Revenue Source Itep

Michigan Inheritance Laws What You Should Know

Taxing Inheritances Is Falling Out Of Favour The Economist

How Could We Reform The Estate Tax Tax Policy Center

Estate And Inheritance Taxes Urban Institute

Michigan Probate Laws What You Need To Know

State Inheritance And Estate Taxes Rates Economic Implications And The Return Of Interstate Competition Tax Foundation