alameda county property tax history

Dear Alameda County Residents. Click on the map to expand.

Search Unsecured Property Taxes

Alameda County Tax Records are documents related to property taxes employment taxes taxes on goods and services and a range of other taxes in Alameda County California.

. Type Any Name Search Now. Dear Alameda County Residents. The valuation factors calculated by the State Board of Equalization and.

The valuation factors calculated by the State Board of Equalization and. They are maintained by. Secured tax bills are payable online from 1062021 to.

The Treasurer-Tax Collector TTC does not conduct in. The County of Alameda explicitly disclaims any representation and warranties including without limitation the implied warranties of merchantability and fitness for a particular purpose. Dear Alameda County Residents.

Ad View Anyones Property Record History. See In Person below. Many vessel owners will see an increase in their 2022 property tax valuations.

1221 Oak Street Room 131 Oakland CA 94612. Alameda County Property Tax Payment History. Single Family Residential Homes Used as Such.

Alameda County Treasurer-Tax Collector. Records from 1969 to present are in electronic. The median property tax in Alameda County California is 3993 per year for a home worth the median value of 590900.

Ad View public property records including property assessment mortgage documents and more. Get FREE ALAMEDA COUNTY PROPERTY RECORDS directly from 38 California govt offices 55 official property records databases. The valuation factors calculated by the State Board of Equalization and.

Ad Connect To The People Places In Your Neighborhood Beyond. The valuation factors calculated by the State Board of Equalization and. Get In-Depth Property Reports Info You May Not Find On Other Sites.

Many vessel owners will see an increase in their 2022 property tax valuations. The valuation factors calculated by the State Board of Equalization and. Public Property Records provide information on homes land or commercial properties including titles mortgages property deeds and a range of other documents.

Many vessel owners will see an increase in their 2022 property tax valuations. The median property tax also known as real estate tax in Alameda County is 399300 per year based on a median home value of 59090000 and a median effective property tax rate of. Secured tax bills are payable online from 1062021 to 6302022.

This generally occurs Sunday. Many vessel owners will see an increase in their 2022 property tax valuations. Records prior to 1969 are on microfilm and must be searched by hand at the Alameda County Clerk-Recorders Office.

This generally occurs Sunday. Dear Alameda County Residents. Lookup or pay delinquent prior year taxes for or earlier.

Dear Alameda County Residents. The system may be temporarily unavailable due to system maintenance and nightly processing. Many vessel owners will see an increase in their 2022 property tax valuations.

The system may be temporarily unavailable due to system maintenance and nightly processing. Discover public property records and information on land house and tax online. Alameda County collects on average 068 of a propertys.

Lookup or pay delinquent prior year taxes for or earlier. This map shows property tax in correlation with square footage of the property. Year Property class Assessment value Total tax rate Property tax.

Piedmont Civic Association Piedmont California Sewer Surcharge And Other Piedmont Parcel Taxes Not Tax Deductible

Alameda County California Genealogy Familysearch

1501 Central Ave Alameda Ca 94501 Mls 41006697 Redfin

Auditor Controller Treasurer Tax Collector County Of San Bernardino Countywire

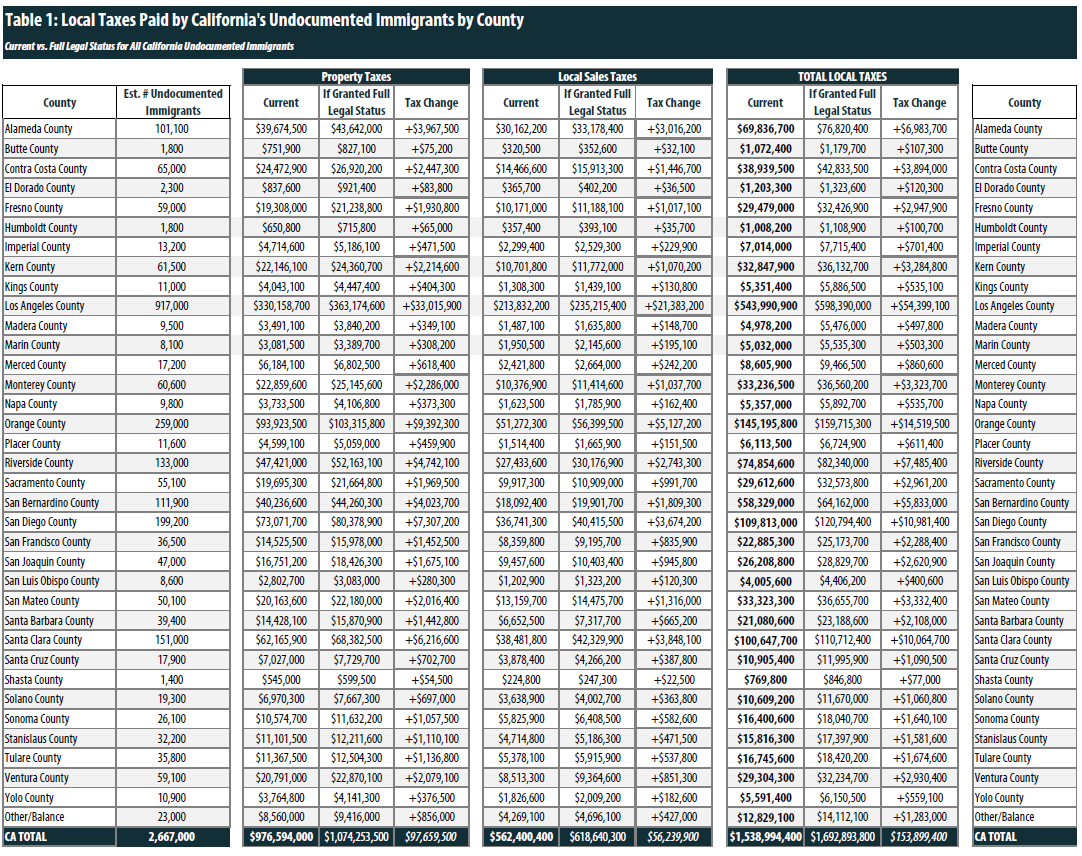

State And Local Tax Contributions Of Undocumented Californians County By County Data Itep

Tax Information Alameda Free Library

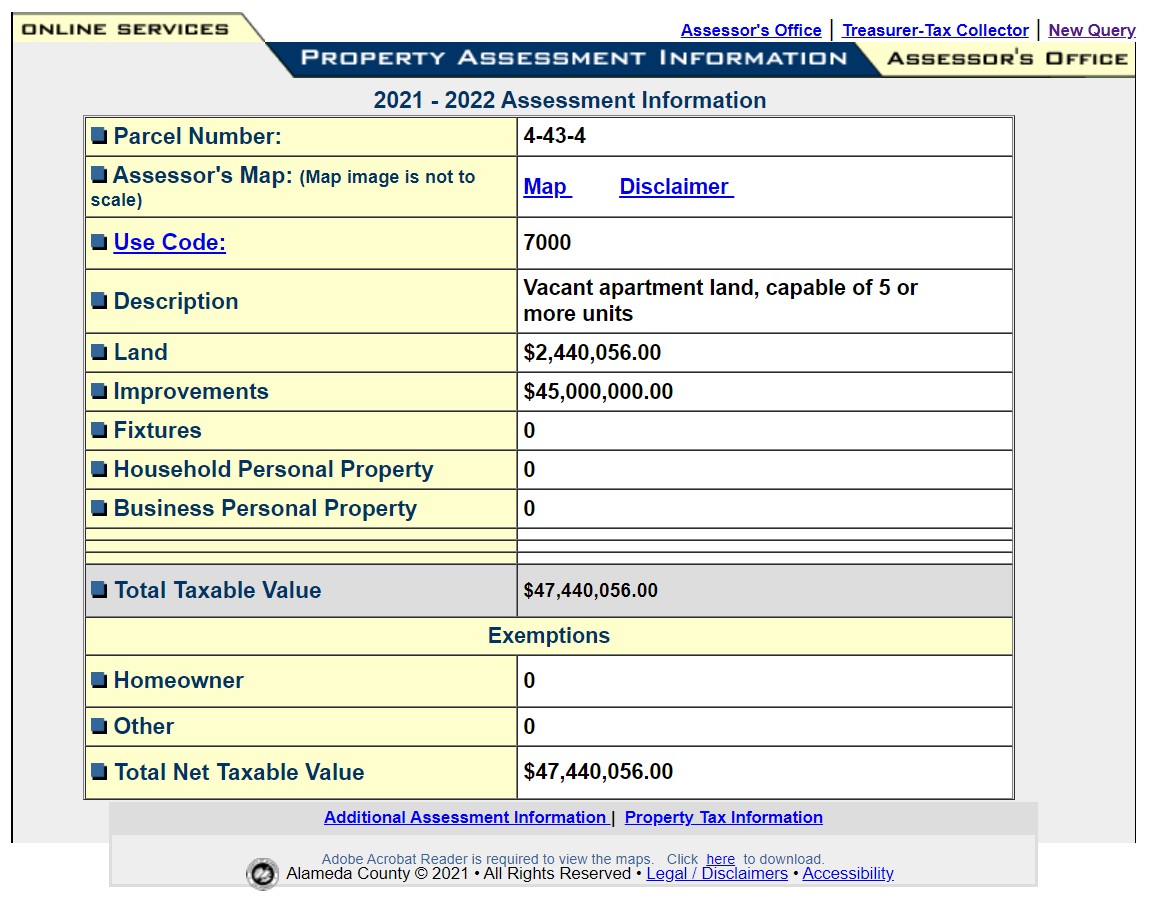

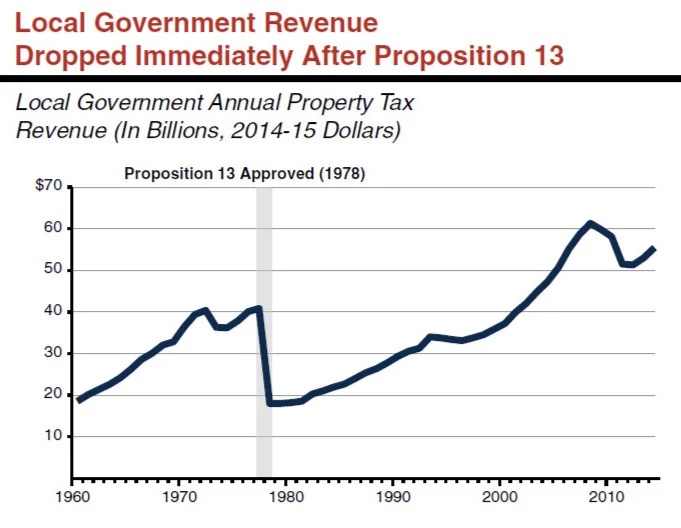

Understanding California S Property Taxes

Voter S Guide For June Primary Alameda Post

Lisjan Ohlone History Territory The Sogorea Te Land Trust

How To Find And Research Pre Foreclosure Houses Properties Abdullah Yahya

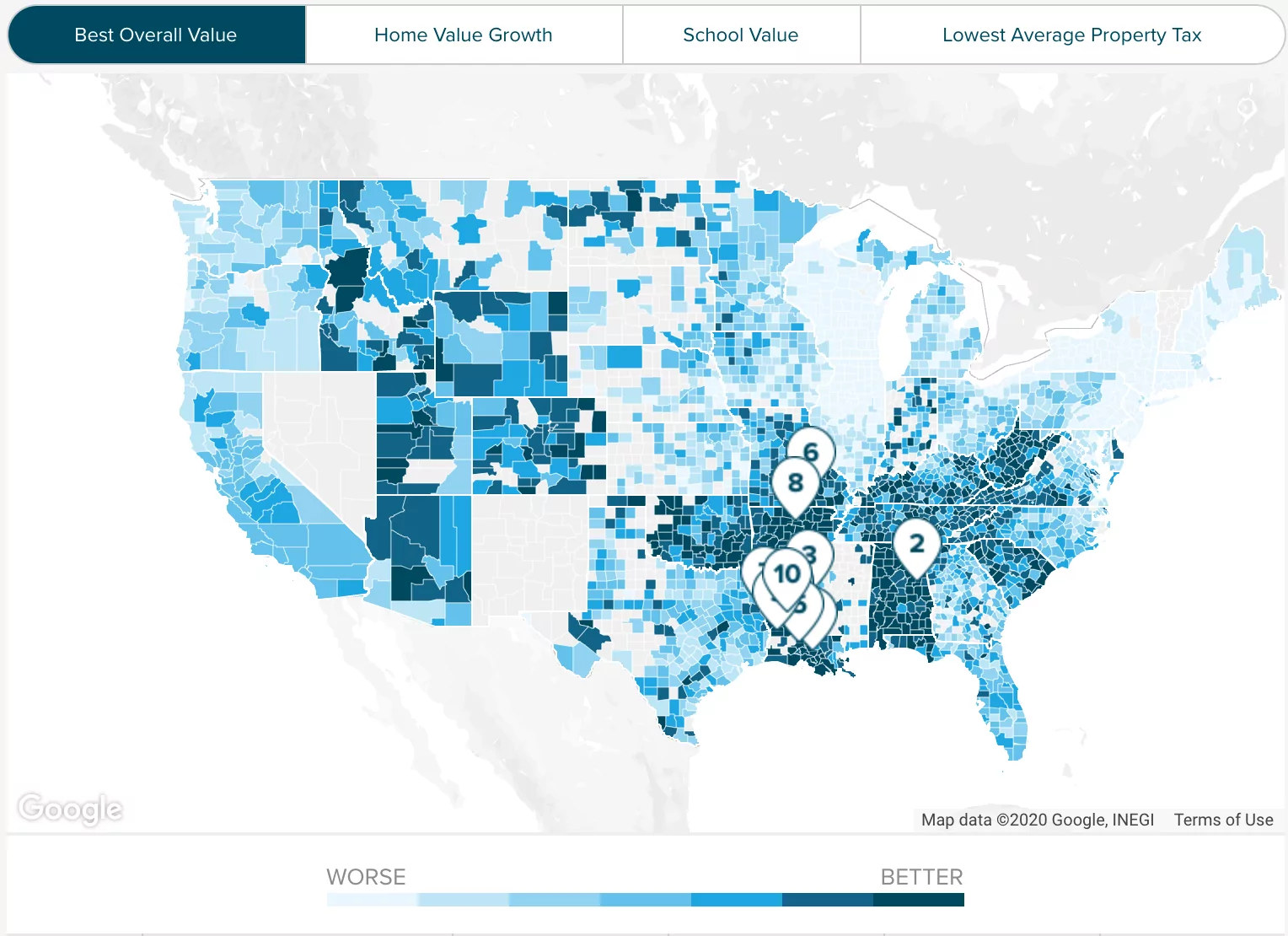

Alameda County Property Tax 2022 Ultimate Guide To Alameda County Oakland Property Tax Rates Search Payments Dates

Tax Guide Best City To Buy Legal Weed In California Leafly

Will Your California Property Tax Skyrocket In 2020 Wynnecre Orange County Commercial Real Estate Experts

Editorial Prop 5 Worsens Our Broken Property Tax System

Alameda County Ca Property Tax Calculator Smartasset